- Home

- »

- Business Solutions

- »

- Taxation-backup

Taxation-backup

IRS & CRA E-Filed corporate returns for all types of business structures.

INCOME

TAXATION SOLUTIONS

IRS & CRA E-Filed corporate returns for all types of business structures.

-

E-Filing

-

Deductions

-

Credits

-

Payments

-

Penalties & Extensions

-

Tax Planning

Strategic Tax planning

for optimal growth

Our tax advisors are experts in implementing strategies to help decrease your taxable liabilities and increase your tax refunds.

-

Identify strengths and weaknesses

-

Optimize operational efficiency

-

Increase revenue streams

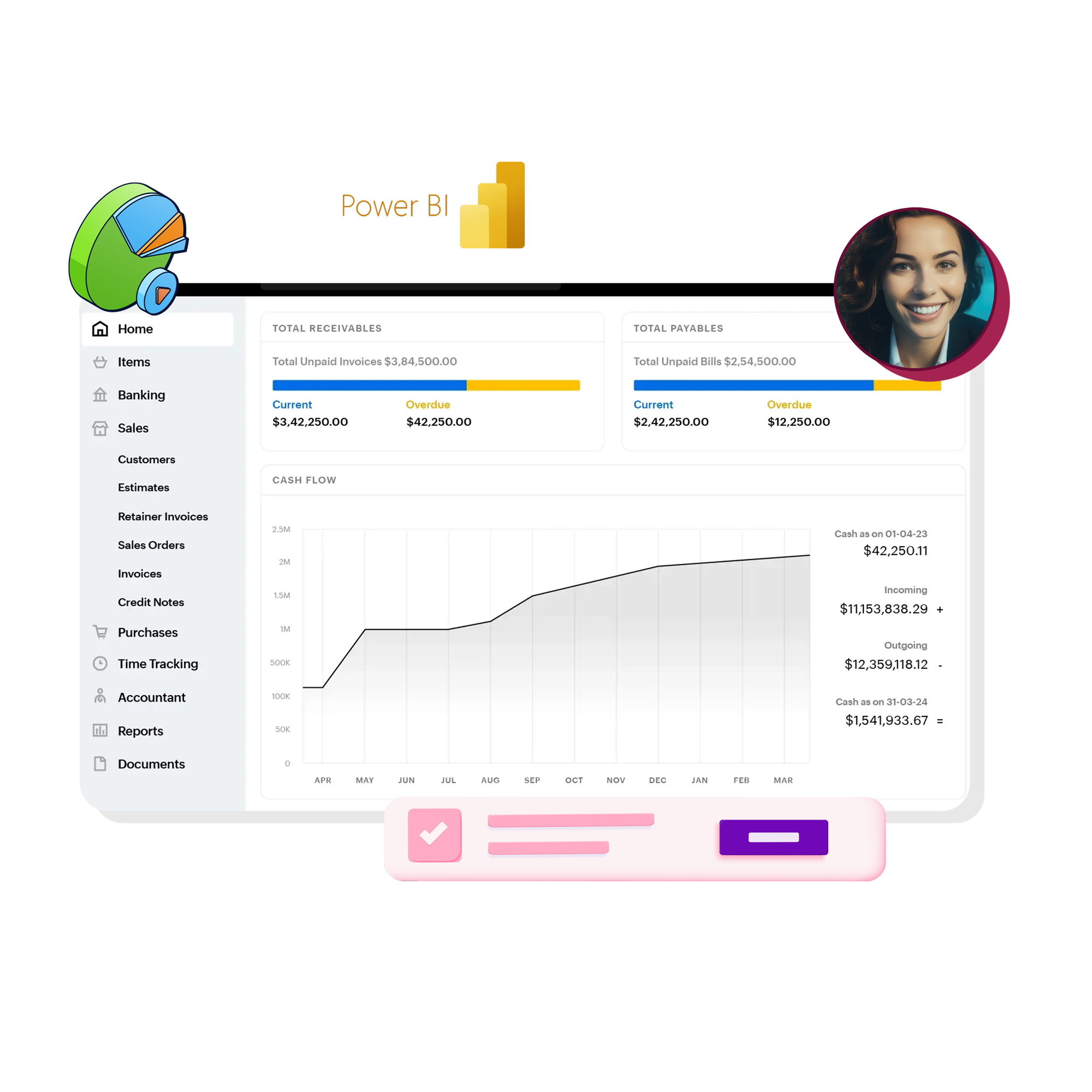

ACCOUNTING &

BOOKKEEPING FOR

SMALL BUSINESSES

Monitoring and categorizing business expenses to manage costs effectively, and creating financial reports, such as balance sheets, income statements, and cash flow statements, to provide a clear picture of the business's financial health.

-

CATEGORIZATION & RECONCILIATION

-

ACCOUNTS RECEIVABLES

-

ACCOUNTS PAYABLE

-

STATEMENTS

-

ANALYSIS

-

coa

PLAYBOOKS

PLAYBOOK -

TAX SOLUTIONS

View our playbooks for more details on how our workflows can help your business streamline its processes.

Pricing

Flexible pricing that scales

with your business

A.I powered taxation solutions for every phase of your finance journey.

FAQ'S

frequently

asked questions

Have some questions about onboarding or refund policies? We have a few of those answers below.

IMPORTANT TERMS

KNOWLEDGE

BASE

get familiar with these key terms with our official wiki databases.

Income Tax

Track balances, transactions, and categorize expenditures effortlessly.

Regressive Tax

A regressive tax is a type of tax that is assessed regardless of income, in which low- and high-income earners pay the same dollar amount.

Progressive Tax

A regressive tax system is one in which the tax rate decreases as the taxpayer's income increases. A progressive tax system, on the other hand, is one in which the tax rate increases as the taxpayer's income increases.

LET'S CONNECT

WE'RE HERE

TO HELP

Need to get in contact with us? Please fill out our service form and we will get back to you within 24-48 hrs.

- 413 W 14TH Street, Unit 200

- New York, NY

- 10014

- 1-844-729-4455

- support@rayhill.ai

- Monday to Friday

- 9:00 AM - 5:00 PM